(

Printable PDF)

Confusing Times

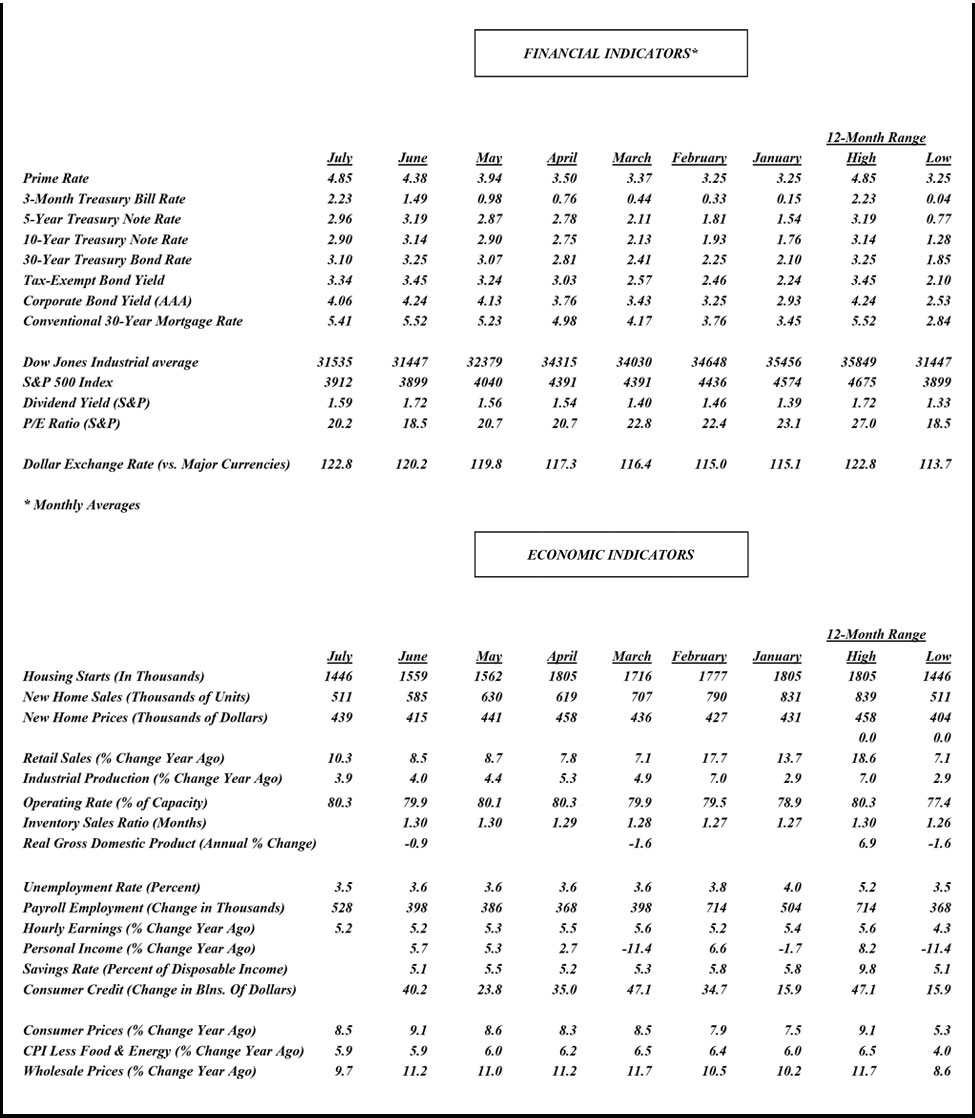

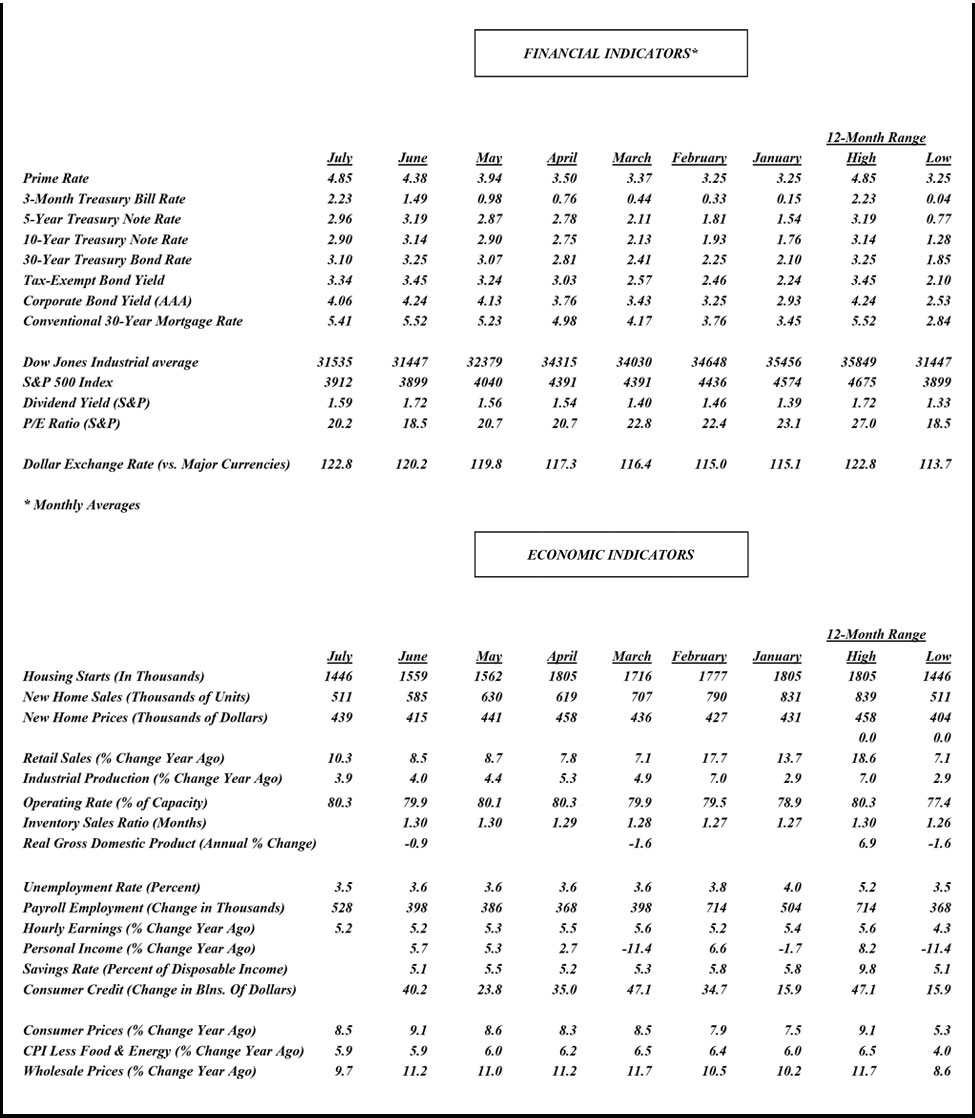

As summer draws to a close, the debate over whether the economy is overheated or rapidly cooling remains unanswered. According to the broadest measure of activity conditions look downright recessionary, as GDP contracted for the second consecutive quarter in the April-June period, satisfying the common yardstick of a recession. But the economy’s fundamental underpinnings depict anything but a downturn. The labor market is hot, churning out more than a half-million jobs in July and driving the unemployment rate to a 50-year low of 3.5 percent. Unsurprisingly, the tight job market is spurring robust wage increases.

This upside-down version of the economy – with output down and incomes up – highlights the confusion over where the economy stands. For the Federal Reserve, which is committed to steadily bringing down inflation by raising interest rates, this is a particularly vexing conundrum. The Fed knows that its rate-hiking campaign will do little to raise output, which is being held back by global supply shortages. But it also knows that demand is outpacing supply – and stoking inflation – and needs to be cooled off via higher interest rates. Finding that sweet spot in rates that will restore equilibrium between demand and supply without causing a deep recession is the most challenging task facing Fed officials.

At this juncture, the path ahead is clear. With inflation running near 40-year highs, policy makers will keep their foot on the brakes for the foreseeable future. Following outsized rate hikes of three-quarters of a percent in June and July, the Fed is poised to lift rates again at its next policy meeting on September 20-21. The only question is whether it will scale back the increase to half-percent or continue to go full bore with another three-quarter-point hike. Either option would still make this the most aggressive rate-hiking campaign since the early 1980’s. So far, however, the steep climb in rates has not undercut consumer spending, the economy’s main growth driver, on a broad scale. How long consumers can stay resilient is the question of the day, as household sentiment is the lowest since the 1950’s and many low- and middle-income households are running out of fuel. If they capitulate, a recession is a virtual certainty.

Positive Start To The Third Quarter

Despite two consecutive quarters of negative GDP, it’s not likely the economy is in a recession. The National Bureau of Economic Research (NBER) is the recognized arbiter of when recessions begin and end, and the organization uses a broad array of indicators to make the call. At this juncture, the evidence is not confirming a downturn as two key variables it monitors, employment and income, advanced briskly over the first half of the year.

What’s more, the third quarter is starting off on a positive note – even on the output side, which is what GDP measures. Industrial production is one of the six indicators the NBER considers in determining when a recession begins, and the production index notched a solid 0.6 percent increase in July following two soft months in May and June. Importantly, output of motor vehicles led the way, suggesting that supply shortages which victimized the auto sector more than most others, is finally easing, something that would greatly aid the Fed in curbing inflationary pressures. One sign indicating supply chain snarls are thawing is that manufacturers are reporting shorter delivery times to obtain goods needed for production, according to the latest survey by the Institute for Supply Management.

To be sure, supply chain disruptions continue to pose a serious inflation threat. The war in Ukraine is still raging on, suppressing energy supplies as well as grains, fertilizer, corn, and wheat, which is driving up food prices. Also, China’s Covid-zero policy continues to have a stifling effect on factory output, which delivers many of the goods U.S. manufacturers need for production. Meanwhile, severe drought conditions globally and in the American West are destroying crops and upending farming, reinforcing upward pressure on food prices. Simply put, the recent output gain in the U.S. is a welcome step towards easing supply shortages, but with so many potential challenges to overcome there is no guarantee it will continue.

Shifting Consumer Buying Habits

Fortunately, the restraints on supply have become less inflationary because consumers are shifting their spending patterns. Throughout the pandemic, consumers were stuck in their homes, working remotely to fulfill job responsibilities wherever possible. As the pandemic lasted longer than expected and remote work became more entrenched, people retrofitted their homes to accommodate an extended presence, stocking up on furnishings, exercise equipment, personal computers, and other physical goods to create a more pleasant working and living environment.

The demand for these items was stoked by trillions of dollars in Federal stimulus payments and cash flow that was freed up by unspent funds on services. The surge in demand caught goods-producers off guard. Many had scaled back capacity growth in the slow-growth years following the Great Recession; when demand briefly collapsed during the onset of the pandemic many shut down plants completely, fearing a long slog of weak activity. As a result, factories were unable to ramp up production fast enough to meet the surprising post-pandemic surge in demand, resulting in shortages of goods and the inflation spike that the Fed is now trying to control.

But with improving health conditions and the reopening of the economy this year, households have gradually engaged in more outdoor activities, going to concerts, sporting events, restaurants, and traveling more, reducing the need for physical goods. Not surprisingly, prices of the products that were so much in demand during pandemic lockdowns are now retreating, including TVs, personal computers, and other durable goods. Indeed, many retailers are stuck with excess inventories, prompting price markdowns that have hurt their bottom lines. This shift in consumer spending towards services should continue in coming months and further ease pressure on goods prices.

Sticky Prices

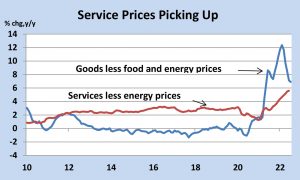

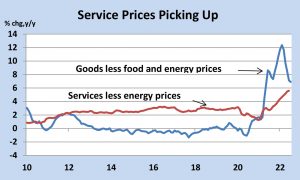

Still, making physical goods cheaper is only one-small step towards reining in inflation, which, despite a modest cooling in July, remains near a 40-year high. Even before consumers shifted away from goods purchases, they spent the greater share of their budgets on services. Unsurprisingly, with demand for services strengthening, prices are rising faster. Importantly, service prices are much stickier than goods prices and curbing their increase is a more daunting task for the Federal Reserve.

One reason service prices are harder to bring down is because service providers rely more heavily on labor than goods-producers, and labor costs are harder to curb. Indeed, wages are rising at the most rapid clip in 40 years, thanks to worker shortages that are particularly acute in the service sector. The job vacancy rate at eating and drinking establishments, for example, is the highest in the private sector, 35 percent above what it is in manufacturing. The fierce competition to attract workers is driving up wages, prompting employers to pass on higher labor costs to customers. For the most part, consumers still have the financial muscle and willingness to accept higher prices, as evidenced by the sustained strength in retail sales in July.

Pricing power has its limits, and consumers are increasingly resisting price increases; they are opting for cheaper substitutes wherever possible or foregoing discretionary purchases entirely. This is particularly true for low- and middle-income households whose budgets are being squeezed by rising food and housing costs. Despite accelerating wages, workers are not keeping up with price increases, underscoring why households complain that inflation is the biggest threat to their livelihood and the prime reason sentiment is the lowest in 50 years.

Policy Risks

Since employers rarely cut wages, their main option to cut labor costs is by laying off workers. So far, hires continue to outpace layoffs because higher prices have not discouraged sales on a broad scale. But as noted, price resistance is building and rising interest rates are taking a toll on leveraged purchases. Home sales, the most rate-sensitive sector of the economy, are plunging, which will lead to lost sales of furnishings, appliances and reduced moving expenses. New construction spending is also falling; once the heavy load of projects under construction is completed, construction workers will be getting pink slips. As the trend towards slower employment growth continues, worker bargaining power will weaken.

That outcome, is precisely what the Fed is striving to bring about. The hope is that its rate-hiking effort to slow demand will lead to a slower pace of hiring – and slower wage increases – but not massive layoffs and a deep recession. This is a fine line that the Fed has failed to navigate successfully in the past, largely because policy changes affect the economy with a lag, with unpredictable outcomes. Yet decisions are made based on unfolding events, which at the moment argues for the Fed to keep its foot on the brake.

Achieving a soft landing is still a possibility, given the healthy balance sheets of households and sturdy increases in jobs and wages. But pandemic-era savings have been depleted and Federal aid has run out, leaving consumers much more vulnerable to shocks. One in six Americans are already falling behind in utility bills and cracks on the labor front are appearing. According to the latest PwC Pulse survey, 50 percent of companies are reducing headcount, 46 percent are dropping or reducing signing bonuses and 44 percent are rescinding offers. Over the first half of the year, inflation dented consumer confidence more than spending, but if the job market rolls over, spending will also capitulate, bringing on a recession.

Although inflation has likely peaked, it will probably stay elevated and recede slowly, thanks to sticky service prices and ongoing supply shortages. The longer it takes to reach the Fed’s 2 percent target the more likely the Fed will be to keep raising interest rates, upping the odds it will go too far and induce a recession. Then, the question becomes how deep a recession will policymakers tolerate to restore price stability.

Brookline Bank Executive Management

(Printable PDF)

(Printable PDF)

This upside-down version of the economy – with output down and incomes up – highlights the confusion over where the economy stands. For the Federal Reserve, which is committed to steadily bringing down inflation by raising interest rates, this is a particularly vexing conundrum. The Fed knows that its rate-hiking campaign will do little to raise output, which is being held back by global supply shortages. But it also knows that demand is outpacing supply – and stoking inflation – and needs to be cooled off via higher interest rates. Finding that sweet spot in rates that will restore equilibrium between demand and supply without causing a deep recession is the most challenging task facing Fed officials.

At this juncture, the path ahead is clear. With inflation running near 40-year highs, policy makers will keep their foot on the brakes for the foreseeable future. Following outsized rate hikes of three-quarters of a percent in June and July, the Fed is poised to lift rates again at its next policy meeting on September 20-21. The only question is whether it will scale back the increase to half-percent or continue to go full bore with another three-quarter-point hike. Either option would still make this the most aggressive rate-hiking campaign since the early 1980’s. So far, however, the steep climb in rates has not undercut consumer spending, the economy’s main growth driver, on a broad scale. How long consumers can stay resilient is the question of the day, as household sentiment is the lowest since the 1950’s and many low- and middle-income households are running out of fuel. If they capitulate, a recession is a virtual certainty.

This upside-down version of the economy – with output down and incomes up – highlights the confusion over where the economy stands. For the Federal Reserve, which is committed to steadily bringing down inflation by raising interest rates, this is a particularly vexing conundrum. The Fed knows that its rate-hiking campaign will do little to raise output, which is being held back by global supply shortages. But it also knows that demand is outpacing supply – and stoking inflation – and needs to be cooled off via higher interest rates. Finding that sweet spot in rates that will restore equilibrium between demand and supply without causing a deep recession is the most challenging task facing Fed officials.

At this juncture, the path ahead is clear. With inflation running near 40-year highs, policy makers will keep their foot on the brakes for the foreseeable future. Following outsized rate hikes of three-quarters of a percent in June and July, the Fed is poised to lift rates again at its next policy meeting on September 20-21. The only question is whether it will scale back the increase to half-percent or continue to go full bore with another three-quarter-point hike. Either option would still make this the most aggressive rate-hiking campaign since the early 1980’s. So far, however, the steep climb in rates has not undercut consumer spending, the economy’s main growth driver, on a broad scale. How long consumers can stay resilient is the question of the day, as household sentiment is the lowest since the 1950’s and many low- and middle-income households are running out of fuel. If they capitulate, a recession is a virtual certainty.

To be sure, supply chain disruptions continue to pose a serious inflation threat. The war in Ukraine is still raging on, suppressing energy supplies as well as grains, fertilizer, corn, and wheat, which is driving up food prices. Also, China’s Covid-zero policy continues to have a stifling effect on factory output, which delivers many of the goods U.S. manufacturers need for production. Meanwhile, severe drought conditions globally and in the American West are destroying crops and upending farming, reinforcing upward pressure on food prices. Simply put, the recent output gain in the U.S. is a welcome step towards easing supply shortages, but with so many potential challenges to overcome there is no guarantee it will continue.

To be sure, supply chain disruptions continue to pose a serious inflation threat. The war in Ukraine is still raging on, suppressing energy supplies as well as grains, fertilizer, corn, and wheat, which is driving up food prices. Also, China’s Covid-zero policy continues to have a stifling effect on factory output, which delivers many of the goods U.S. manufacturers need for production. Meanwhile, severe drought conditions globally and in the American West are destroying crops and upending farming, reinforcing upward pressure on food prices. Simply put, the recent output gain in the U.S. is a welcome step towards easing supply shortages, but with so many potential challenges to overcome there is no guarantee it will continue.

But with improving health conditions and the reopening of the economy this year, households have gradually engaged in more outdoor activities, going to concerts, sporting events, restaurants, and traveling more, reducing the need for physical goods. Not surprisingly, prices of the products that were so much in demand during pandemic lockdowns are now retreating, including TVs, personal computers, and other durable goods. Indeed, many retailers are stuck with excess inventories, prompting price markdowns that have hurt their bottom lines. This shift in consumer spending towards services should continue in coming months and further ease pressure on goods prices.

But with improving health conditions and the reopening of the economy this year, households have gradually engaged in more outdoor activities, going to concerts, sporting events, restaurants, and traveling more, reducing the need for physical goods. Not surprisingly, prices of the products that were so much in demand during pandemic lockdowns are now retreating, including TVs, personal computers, and other durable goods. Indeed, many retailers are stuck with excess inventories, prompting price markdowns that have hurt their bottom lines. This shift in consumer spending towards services should continue in coming months and further ease pressure on goods prices.

One reason service prices are harder to bring down is because service providers rely more heavily on labor than goods-producers, and labor costs are harder to curb. Indeed, wages are rising at the most rapid clip in 40 years, thanks to worker shortages that are particularly acute in the service sector. The job vacancy rate at eating and drinking establishments, for example, is the highest in the private sector, 35 percent above what it is in manufacturing. The fierce competition to attract workers is driving up wages, prompting employers to pass on higher labor costs to customers. For the most part, consumers still have the financial muscle and willingness to accept higher prices, as evidenced by the sustained strength in retail sales in July.

Pricing power has its limits, and consumers are increasingly resisting price increases; they are opting for cheaper substitutes wherever possible or foregoing discretionary purchases entirely. This is particularly true for low- and middle-income households whose budgets are being squeezed by rising food and housing costs. Despite accelerating wages, workers are not keeping up with price increases, underscoring why households complain that inflation is the biggest threat to their livelihood and the prime reason sentiment is the lowest in 50 years.

One reason service prices are harder to bring down is because service providers rely more heavily on labor than goods-producers, and labor costs are harder to curb. Indeed, wages are rising at the most rapid clip in 40 years, thanks to worker shortages that are particularly acute in the service sector. The job vacancy rate at eating and drinking establishments, for example, is the highest in the private sector, 35 percent above what it is in manufacturing. The fierce competition to attract workers is driving up wages, prompting employers to pass on higher labor costs to customers. For the most part, consumers still have the financial muscle and willingness to accept higher prices, as evidenced by the sustained strength in retail sales in July.

Pricing power has its limits, and consumers are increasingly resisting price increases; they are opting for cheaper substitutes wherever possible or foregoing discretionary purchases entirely. This is particularly true for low- and middle-income households whose budgets are being squeezed by rising food and housing costs. Despite accelerating wages, workers are not keeping up with price increases, underscoring why households complain that inflation is the biggest threat to their livelihood and the prime reason sentiment is the lowest in 50 years.