Slowing Inflation Offers Hope for 2023

Murphy’s Law played out in dramatic fashion last year, as virtually anything that could go wrong seemingly did. The pandemic morphed into a new variant; Russia’s invasion of Ukraine ignited a spike in energy, food and other commodity prices that reinforced the worst inflation outbreak in 40 years; the Federal Reserve embarked on the most aggressive rate-hiking campaign since the early 1980s, and the stock market suffered its worst performance since the Great Recession; the bond market fared even worse, enduring the most severe setback on record. Against this backdrop, all we can say is “good riddance” to 2022 and hope for a better 2023.

That said, it’s hard to be too optimistic about the economic outlook for this year. For one, a recession may be in the cards. Indeed, the consensus of economists believes that the economy will enter a downturn beginning in late spring or summer. Even the Federal Reserve is implicitly signaling that one will occur. In its mid-December policy meeting, the Fed predicted that the unemployment rate would rise to 4.6 percent this year from the current 3.5 percent. A rise of that magnitude has never occurred outside of a recession. What’s more, there are plenty of things that can still go wrong. Geopolitical tensions could escalate, problems with supply could persist, and inflation could remain stubbornly high, to name just three. More immediately, political brinkmanship could lead to a confidence-shattering debt crisis.

But there are also reasons to view the year ahead in a more positive light. A recession, if it does occur, should be mild and help correct the imbalances that contributed to the inflation outbreak. Importantly, despite the myriad shocks that buffeted the nation last year, the economy was remarkably resilient. True, GDP contracted over the first two quarters, which fits the traditional definition of a recession. But jobs continued to be created at a breakneck pace – so it clearly didn’t feel like a recession. Importantly, the new year is beginning with some bright spots; jobs are still plentiful and inflation has apparently peaked, lessening pressure on the Fed to take more drastic action. Despite all the challenges ahead, the economic glass could be viewed as being more half full than half empty, which is another way of saying there is reason to be cautiously optimistic about 2023.

Reasons for Optimism

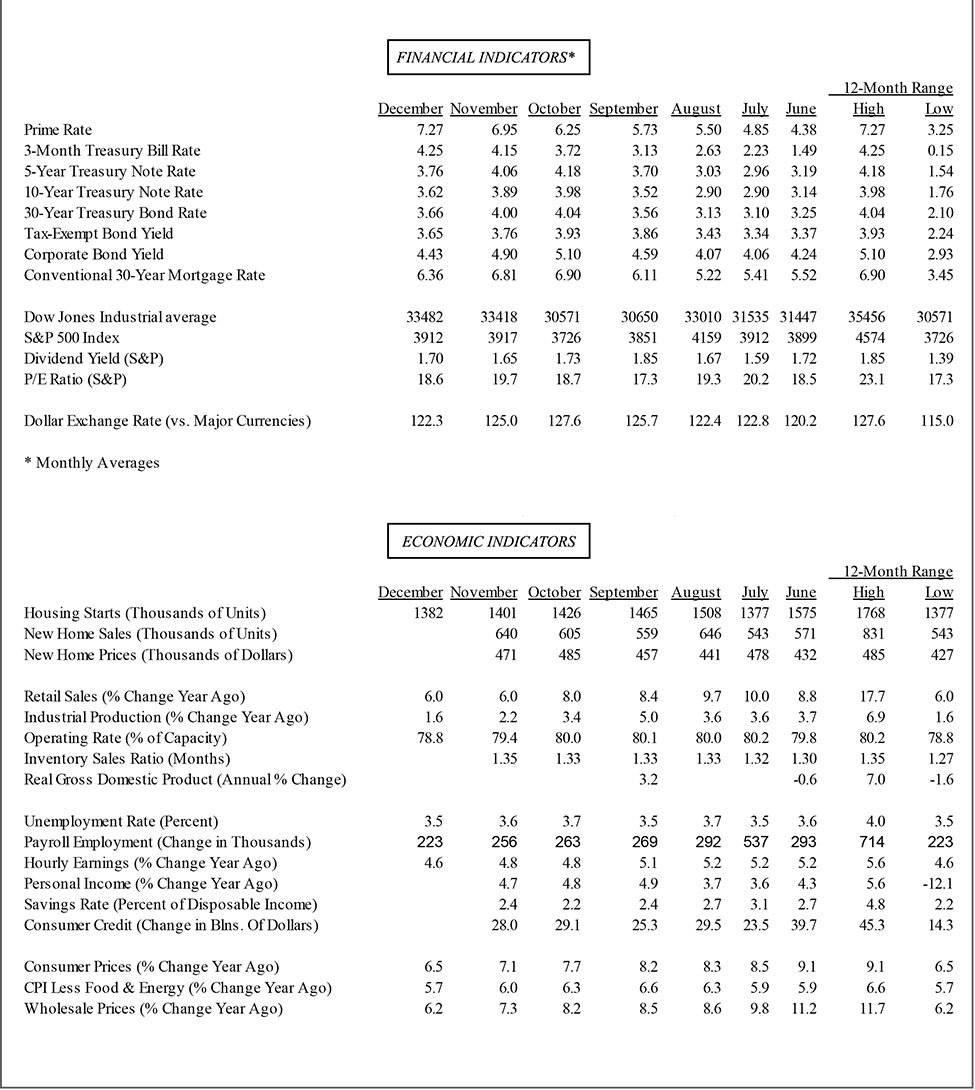

With each passing month it is becoming increasingly apparent that the inflation peak is in the rear-view mirror. The Consumer Price Index increased 6.5 percent from a year ago in December, down sharply from 9.1 percent in June. Excluding volatile food and energy items, the so-called core CPI also slowed noticeably, to 5.7 percent from 6.6 percent. Both gauges are still running well ahead of the Federal Reserve’s 2 percent target, but a manageable resting point is within reach. Indeed, over the past three months, the CPI has increased at an annual rate of 2.65 percent.

The quicker inflation recedes, the less pressure there is on the Federal Reserve to keep its foot on the monetary brakes. As much as anything, this prospect gives hope that the Fed can bring about a soft landing, i.e., taming inflation without inducing a recession. As it is, Fed officials are already pulling back a bit. The half-point rate hike put through at the December policy meeting was a step down from the three-quarter point increases in each of the four previous meetings. The next meeting that concludes on February 1st is again widely expected to yield a smaller increase, possibly by just a quarter-point.

The tilt to a more gradual pace of rate increases no doubt received a boost from the recent benign inflation readings. But some Fed officials also think a less aggressive rate-hiking campaign is warranted because it gives them time to assess the impact that previous rate increases are having on the economy. It’s important to remember that monetary policy affects the economy with long and variable lags, and the cumulative 4.25 percentage point increase put through in 2022 is still working its way through the spending stream. The deep erosion in housing activity and plunge in auto sales is a stark indication of how much damage can be wrought by an abrupt and steep increase in interest rates. The fact that some Fed officials are publicly recognizing this sentiment is a hopeful sign that policy makers will not go overboard in their inflation-fighting efforts and send the economy into a deeper tailspin.

Making Sense of the Consumer Pullback

While the economy staged a respectable increase in GDP in the fourth quarter, it was clearly losing momentum as 2022 drew to a close. Most of the gain occurred early in the period when consumers opened their wallets wide for goods that retailers deeply discounted to unload unwanted inventories. After that spending spree in October, households pulled back sharply, sending retail sales lower in both November and December. Overall, the holiday shopping season was a big disappointment.

But it would be a mistake to overemphasize the setback in retail sales, almost all of which were for goods. When people were stuck in their homes during the pandemic, the demand for goods surged. Purchases of home furnishings, appliances, gym equipment, TVs, and other products that enhance the home-life experience flew out of stores as quickly as they arrived. The spike in demand, which was nourished greatly by generous government stimulus payments, collided with supply shortages, sparking the inflation outbreak that has become the economy’s main scourge.

But by last summer, supply chain snarls had eased up, and companies that had huge unfilled orders were suddenly swamped with goods just as pent-up demand of households had dried up. With the pandemic’s grip waning, people fled the confines of their homes and flocked to companies offering experiences – travel, entertainment, sporting events and the like – diverting less of their budgets to goods and more to services. Simply put, the weakness in retail sales in recent months reflects shifting consumer buying preferences as much as a pullback in overall demand.

Still Fuel in the Tank

Since consumers account for 70 percent of total economic activity, their willingness to spend will go a long way towards determining how well the economy can withstand the headwinds of higher interest rates and inflation this year. On this score, there is both good and bad news. The good news is that consumers still have some firepower to keep their wallets open. The biggest tailwind at their backs is the still healthy job market. For sure, job growth is slowing from the breakneck pace seen over the two years the economy rebounded from the pandemic-induced recession in the spring of 2020. But job creation in the final months of 2022 was still far stronger than it was prior to the pandemic.

With the cutback in consumer goods spending, which has spilled over to less factory production, the slowdown in job growth will no doubt continue. However, it’s unlikely that employment will actually contract over the next several months. Some industries, most notably the tech sector, are shedding an eye-opening number of workers. But those affected are being snapped up by other firms that can use their skills, so overall joblessness has remained contained. Indeed, applications for unemployment benefits were still near historic lows in January. As long as payroll growth is still positive and lifting aggregate wages and salaries, households will have a formidable source of financial support to keep on spending.

The bad news is that wage growth is not keeping up with inflation, and the pandemic-era buildup of savings that filled the gap is vanishing. That’s particularly the case for lower- and middle-income households who devote a larger share of their paychecks to food, rent, and other essentials whose prices have increased faster than discretionary goods and services. And while jobs are still growing, companies are cutting back employee hours, erasing some of the income gains workers are deriving from expanding paychecks.

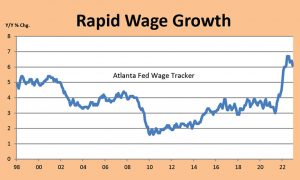

The loss of purchasing power amid a still-tight labor market indicates that workers will demand bigger raises if they can, sustaining pressure on employers to cover costs by raising prices. This prospect is what keeps the Federal Reserve up at night, as the fear of a classic wage-price spiral fueling inflation lurks in the background. It also strengthens the hand of the monetary hawks that favor steeper rate increases to short-circuit that spiral.

Cloudy Crystal Ball

Since the Fed sees labor costs as the main driving force sustaining inflation, it will keep raising rates until there is clear evidence that the job market is cooling off. What metrics it is looking at is unclear. Ideally wage growth of 3–3.5 percent combined with productivity growth of 1.5 percent would be consistent with a 2 percent inflation rate – the Fed’s target over time. Neither of those yardsticks is being met.

According to the Atlanta Federal Reserve’s wage tracker, wages are rising at a 6 percent rate and productivity has actually declined by more than 1 percent over the past year. The Fed’s preferred measure of labor costs, the Employment Cost Index, has increased by 5.3 percent in last year’s third quarter from a year earlier.

The Fed is hoping that wages slow if companies continue to rein in hiring, reducing the gap between the demand and supply of workers. There is a wide cushion to deflate for that to happen, as job openings are 1.7 times larger than unemployed workers, well above the pre-pandemic peak of 1.2.

The other way the gap can close is to get more workers off the sidelines, thus increasing the supply of labor. But here too, the task is daunting as the labor force participation rate at 62.2 percent, is a full percentage point below its pre-pandemic peak. If the rate rose to that peak, 2.6 million additional workers would be vying for jobs.

Simply put, it’s easy to cherry-pick data to support a positive and negative view of the outlook. Sectors that are energy intensive and sensitive to higher interest rates faced tough times in 2022, and they still face a bumpy road ahead. But other sectors rebounded strongly and continue to fare well as spending reorients back to services.

The billion dollar question is whether the resilience of the latter group will last or whether the weakness in the poorly performing sectors such as housing and tech will spread. While some slowdown in the stronger group is expected, the fact that inflation is receding, policy tightening is nearing an end, and there are no glaring imbalances in the economy suggests that the looming recession everyone predicts will be mild. Indeed, if inflation recedes more quickly than the Fed expects, it’s possible the U.S. can avoid a recession entirely.

Brookline Bank Executive Management

| Darryl J. Fess President & CEO [email protected] 617-927-7971 |

Robert E. Brown EVP & Division Executive Commercial Real Estate Banking [email protected] 617-927-7977 |

David B. L’Heureux EVP & Division Executive Commercial Banking dl’[email protected] 617-425-4646 |

Leslie Joannides-Burgos EVP & Division Executive Retail and Business Banking [email protected] 617-927-7913 |