The Economic Engine is Running Out of Fuel

Economists are sounding ever-more like Gilda Radner of Saturday Night Live fame, claiming “never mind” about their recession call of a few months ago. What’s behind their mea culpa? Well, the economy for one thing. The drumbeat of stronger-than-expected data continues to roll in, defying perceptions that activity is poised to collapse. Consumers are keeping their wallets wide open, as revealed in the robust retail spending report for July. Businesses are booking more orders for capital equipment and are building more factories; and the job market, while easing a bit, continues to generate far more openings than available workers.

Meanwhile, the inflation surge that prodded the central bank into the most aggressive rate-hiking campaign in forty years is rapidly unwinding, challenging expectations that only a weakening economy and higher unemployment could snuff out excess inflation. There are still some doubts as to whether the disinflationary trend is sustainable, but the progress made may be enough to keep the Federal Reserve on the sidelines at the September 19-20 policy meeting. The question that needs to be answered is whether the economy is running on fumes, with growth being driven by savings left over from the generous pandemic-era government transfer payments. Or is it being powered organically, with sturdy job growth and wages providing a sustained source of forward momentum.

If it is the former, activity could run into a wall later this year when the savings are depleted, and the Fed’s rate hikes take a bigger toll on consumer spending. If it is the latter, the Fed may feel it has more work to do to restore a balance between demand and supply. There is a belief that the economy is vulnerable and will slip into a mild recession early next year, reflecting the lagged impact of the Fed’s rate hikes, tighter credit conditions, the resumption of student loan repayments in October and, yes, the depletion of excess savings that will eventually take steam out of consumer spending. That said, the economy’s resilience is surprising, and given the rapid unwinding of inflation, a soft landing rather than an outright recession could be in the cards if everything falls into place. If nothing else, it does look like inflation can be brought to heel without a huge increase in unemployment, something that had previously been deemed impossible.

Starting With a Bang

If the economy is running on fumes, its engine has more in the tank than anyone expected. Consumers, the main growth driver, started the second half flexing their spending muscles. Retail sales leapt 0.7 percent in July, the strongest monthly gain since the start of the year, and far above the expected increase of 0.4 percent. Retail sales are reported in current dollars, so part of the increase reflected higher prices. But the consumer price index only increased 0.2 percent during the month, so most of the spending advance was for real goods.

Not surprisingly, the sturdy reading on consumers upended expectations regarding the economy’s performance. Following the report, the Atlanta Federal Reserve’s tracking model estimated that the economy was on a path to grow by 5.8 percent in the third quarter. That would be an astonishing performance, marking a major step-up from the 2.0 percent and 2.3 percent pace in the first and second quarters. For sure, it’s still quite early in the period, and hardly anyone believes that pace will be maintained.

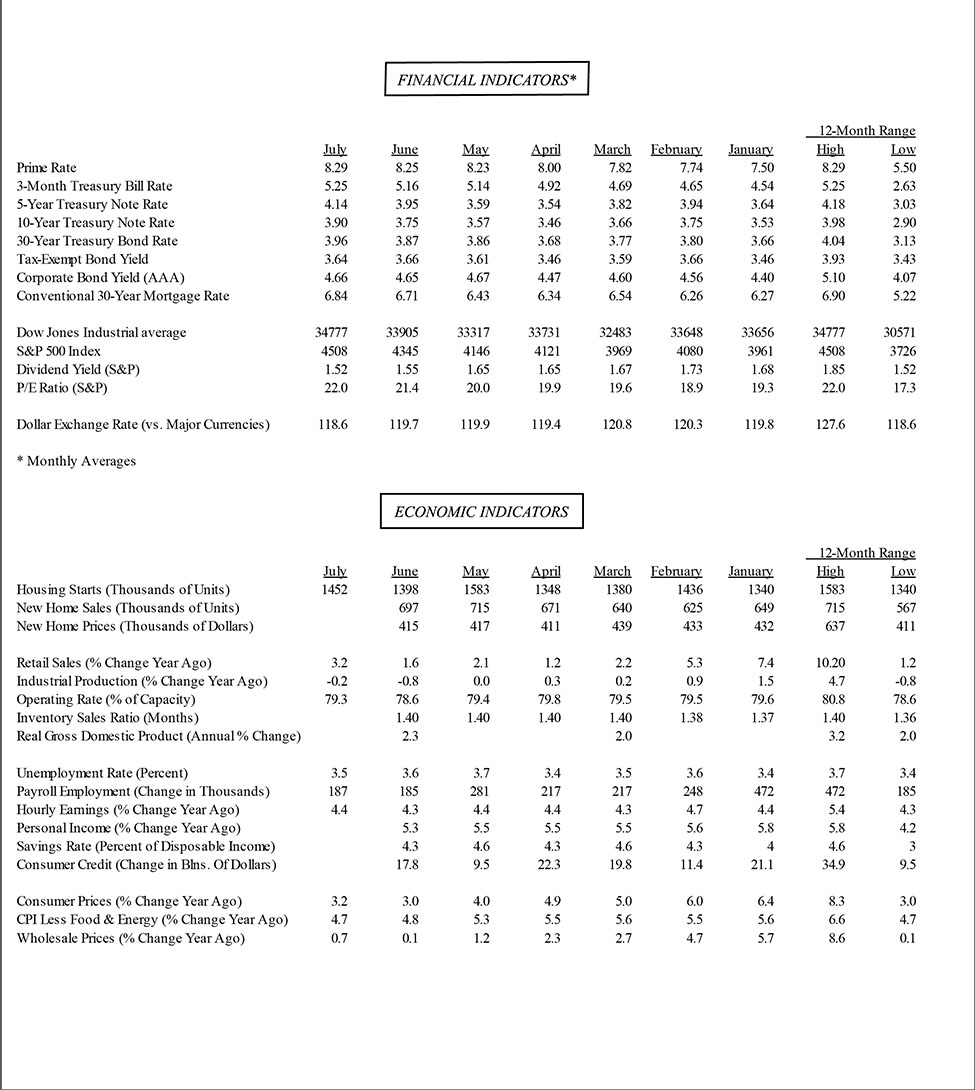

But it drives another nail in the recession forecast for an increasing swath of the economic community. For others, it pushes back the starting date of a downturn into next year, albeit admittedly with less conviction it will occur than was had a few months ago. Even the Federal Reserve’s staff abandoned its earlier forecast of a recession and now expects the economy to remain on a growth path for at least the remainder of the year. It is fair to ask why, after 17 months of rate hikes totaling 5.25 percentage points, the economy has not weakened more than it has. Alternatively, it is just as important to question whether the Fed should continue trying to restrain growth if inflation is already retreating. After all, the goal isn’t to slow growth just for the sake of slowing growth.

Still Room to Run

We never know when a recession starts until the National Bureau of Economic Research, the unofficial timer of business cycles, tells us, and that can be months after it is over. But the economy is obviously cruising above water now despite 17 months of Fed rate hikes. One reason may simply be that the full impact of higher rates hasn’t yet been felt. True, 17 months feels like a long time; but historically, it has taken an average of nearly two years between the central bank’s first rate hike and a recession. If that historical pattern holds, we can expect the downturn to set in early next year.

That’s not to say that the economy has been unscathed from the surge in rates. While consumers overall are still flexing their spending muscles, they are paying considerably more to finance their purchases. Interest rates on credit cards are at record levels – as is credit card debt – and delinquencies are rising, on both credit cards and auto loans. Lenders are responding by raising borrowing standards, pointing to reduced credit availability in coming months. Would-be home buyers are facing even greater hurdles. Mortgage rates recently leapt over 7 percent for the first time in more than 20 years, lifting housing affordability out of reach for a growing swath of households.

Indeed, even those who can still afford to buy a home are finding that there is scant supply to choose from, thanks to high mortgage rates. That’s primarily because homeowners are staying put, not putting their property on the market and giving up the low 3-4 percent mortgage rate obtained when they either refinanced or purchased their home during the low-rate environment prior to the Fed’s tightening campaign. Ironically, this is boosting construction activity, as builders are filling a void in the resale market for existing homes. But to sell those homes, builders are offering rate concessions to buyers, which is not a sustainable model as they too have to borrow funds at ever higher rates.

Depleting Savings

As already noted, the broader economy has weathered the rate hikes so far and there is no sign it is about to fall off a cliff anytime soon. But its main growth driver is about to run on fewer cylinders, pointing to slower growth over the remainder of the year. Most notably, consumers are poised to lose a major source of spending power, as the huge pool of excess savings accumulated since the onset of the pandemic is running dry. Estimates vary as to how much households have padded their bank accounts with the trillions of dollars doled out by the government through its stimulus payments and the funds that were unspent during lockdowns.

But a recent study by the San Francisco Federal Reserve bank provides some idea of the magnitudes involved. The researchers calculated that households accumulated $2.1 trillion in excess savings from early 2020 to August 2021 – that is savings over and above what they would have saved during normal times. Since August 2021, they have dipped into that pool deeply to support spending, averaging about $100 billion a month. After all those drawdowns, it is estimated that only $190 billion of excess savings is left, which the authors estimate will be fully spent by the third quarter of this year.

But a recent study by the San Francisco Federal Reserve bank provides some idea of the magnitudes involved. The researchers calculated that households accumulated $2.1 trillion in excess savings from early 2020 to August 2021 – that is savings over and above what they would have saved during normal times. Since August 2021, they have dipped into that pool deeply to support spending, averaging about $100 billion a month. After all those drawdowns, it is estimated that only $190 billion of excess savings is left, which the authors estimate will be fully spent by the third quarter of this year.

Removing $100 billion a month in spending is not a trivial headwind, considering that it virtually equals the $108 billion average monthly increase in personal consumption from January to June of this year. It means that consumer spending will be more reliant on income growth and/or borrowing. Still, to the extent that these savings have driven spending, that engine is poised to cool down considerably in the final months of the year. Keep in mind too that the scheduled restarting of student loan repayments after September will also deter some spending, particularly among millennials. Simply put, if the economy is indeed running on fumes, they are poised to dissipate soon. The question is, is there enough firepower to keep the growth engine humming, even if in a lower gear?

Tailwinds

That, of course, is where the rubber meets the road for the Federal Reserve. Even if the central bank decides it is finished with hiking rates, as many anticipate, the financial markets are not. Investors are ever-more convinced that the economy has considerable momentum left and have driven up long-term rates sharply over the past month. As of the third week in August, the bellwether 10-year Treasury yield – which strongly influences mortgage and other critical rates in the U.S. – soared to the highest level in about 15 years. Among other things, that indicates investors believe the era of cheap money which prevailed from the 2008 financial crisis to the pandemic is over. The mantra that rates will “remain higher for longer” is firmly embedded in the mind-set of the financial community.

Even if a recession sets in, investors do not believe that interest rates will return to the near-zero level that prevailed over most of the last decade. For one, any recession is expected to be mild and inflation to remain stubbornly above the Fed’s 2 percent target. While shorter-term rates, which the Fed has more control over, have barely budged over the past month, neither have they declined from their elevated levels, reflecting investor expectations that the Fed will not be cutting rates anytime soon. Hence, in addition to the headwinds from reduced savings and student loan repayments, the economy will need to overcome the hurdle of sustained high interest rates to stay afloat.

The question is, can it? The good news is that there are some powerful tailwinds that will counteract the gathering headwinds. One key buffer is the still-strong job market, featuring an unemployment rate near historic lows and sturdy wage gains. Importantly, those gains are occurring alongside easing inflation, a combination that is boosting real incomes. Adding to the crosscurrents buffeting the economy, high interest rates are providing savers with the most generous returns in more than 15 years. No doubt, interest rates inflict more pain than gain when they rise as sharply as they have. But the income boost from higher interest payments accruing to a rapidly aging population should cushion the blow by injecting more purchasing power into retirement accounts. These buffers may not be enough to prevent a recession, but they should limit its severity, and importantly, soften the impact on unemployment.

Brookline Bank Executive Management

| Darryl J. Fess President & CEO [email protected] 617-927-7971 |

Robert E. Brown EVP & Division Executive Commercial Real Estate Banking [email protected] 617-927-7977 |

David B. L’Heureux EVP & Division Executive Commercial Banking dl’[email protected] 617-425-4646 |

Leslie Joannides-Burgos EVP & Division Executive Retail and Business Banking [email protected] 617-927-7913 |