As a Qualified Intermediary under Section 1031 of the Internal Revenue Code, we offer strategic insight and expertise on structuring real property exchanges. Our experienced team has completed more than $30 billion in exchange transactions across the nation.

Brookline Bancorp 1031 Exchange Services provides individuals and institutions with comprehensive, like-kind exchange tax deferral solutions and strategies. Participants can postpone or even eliminate taxes owed on the sale of qualifying properties through a properly executed 1031 exchange.*

Whether you are in Boston, New York, Chicago, or anywhere else in the U.S., the proceeds of your property sales are well cared for when you work with Brookline Bancorp 1031 Exchange Services:

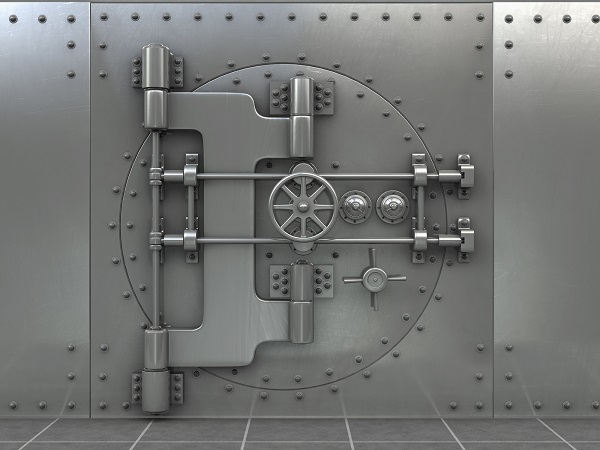

Security of Funds

With Brookline Bancorp 1031 Exchange Services as your Qualified Intermediary you can rest assured that your funds are secure. Each exchange is held in a unique escrow account, segregated from any other account. By design, any movement of funds from the escrow account requires your direction and signature.

Our services are designed to provide clients with a high level of speed, flexibility, ease, and expertise. Brookline Bancorp 1031 Exchange Services will:

We are ready to work with you and your tax and legal advisors to structure the most advantageous 1031 exchange possible.

Call 617-927-7962 today to talk to us about your 1031 exchange situation, or email Tom St. Jean at [email protected].

Brookline Bancorp 1031 Exchange Services, LLC is a subsidiary of Brookline Bank.

*IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. tax advice contained in this communication is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code.