The Case For Lower Rates

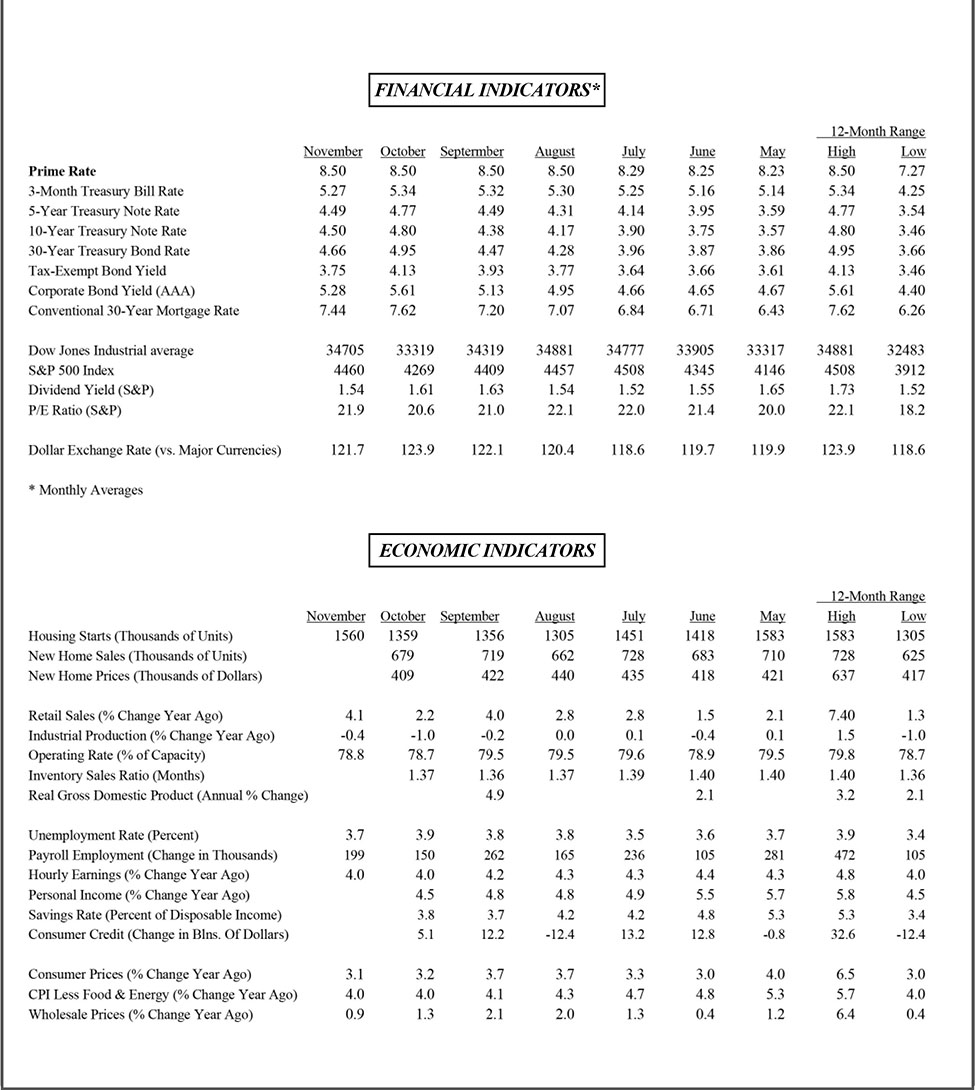

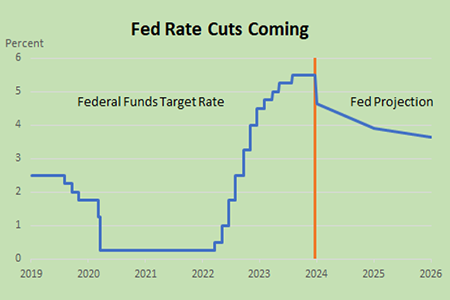

The era of low rates ended in March 2022 when the Federal Reserve started the most aggressive rate-hiking campaign in a generation, lifting its policy rate 11 times from near zero to a range of 5.25-5.50 percent in July of 2023, where it has remained. Until a few weeks ago, the central bank has wavered over what to do next, raise again or keep them “higher for longer”. The bias towards a more belt-tightening policy was understandable: Inflation remained far above the Fed’s 2 percent target and, importantly, the rate hikes seemed to have little effect on the economy. Indeed, GDP accelerated to an eye-opening 4.9 percent growth rate in the third quarter and the unemployment has remained under 4 percent for 22 consecutive months – the longest stretch since the 1960s.

But as the calendar turns to 2024, the central bank is poised to switch gears. At its last policy meeting on December 13, it sent a strong message that the rate-hiking campaign has ended, and the next move will be down. The question is not one of direction but of timing. Fed officials projected three cuts during the year, but not when the first one will come. The financial markets are forecasting an even bolder pivot, pricing in five or six cuts that would take the key policy rate – the federal funds rate – to below 4 percent by the end of 2024. Unsurprisingly, stock and bond prices staged big rallies following the latest Fed meeting.

It’s important to keep in mind that Fed projections are just that — projections, not contracts that must be fulfilled or face legal penalties. Following the first hike in March of 2022, Fed officials predicted that the federal funds rate would wind up under 2 percent by the end of the year. It ended up at 4.5 percent.

It’s also important to remember that financial markets tend to overreact to perceived policy changes, even nuanced ones, and suffer whiplash when perceptions by traders turn out to be wrong. Time will tell if history is about to repeat. The good news is that the Fed appears to be on the right track, after belatedly starting the rate hiking cycle in 2022. Still, it would be a rare accomplishment if policymakers can wrestle inflation down to its 2 percent target without causing a recession. A few months ago, hardly anyone thought that such a soft landing would be possible; now most think it’s likely. The jury is still out as to which is right.

The Fed Pivots

It is not entirely clear why policymakers changed course at its December meeting, and it appears that not all are on board with the projected rate cuts. Clearly, no single catalyst stands out. If anything, underlying conditions are more supportive of staying put. Consumers, the economy’s main growth driver, are still spending at a sturdy pace, the job market is still humming and inflation, while retreating, is still well above the Fed’s 2 percent target. A case can be made that the Fed is risking a premature easing of policy that could reignite the inflation embers.

But it would be a mistake for the Fed to wait until inflation gets much closer to the 2 percent target before cutting rates. By then, it would be too late to cushion the economy from the damage that sustained high rates, not to mention the lagged effects of previous rate increases, would cause. A few months ago, the Fed believed that the risk of sustained high inflation outweighed the risk of a looming recession and a surge in unemployment. Hence, it decided to keep policy geared towards controlling inflation. Now, the Fed perceives the risks to be just about even.

Importantly, policymakers have repeatedly said they would start taking their feet off the brakes when inflation was on a sustainable path towards 2 percent. There is still a ways to go before that target is hit, but the trend is encouraging enough to believe it has staying power. Most inflation gauges are running at annual rates of 3 percent or less over the last three to six months, and prices of many goods are actually declining, thanks to the healing of supply chain snarls that caused widespread product shortages during the pandemic. Many scoffed at the notion, held by the Fed in 2021, that the surge in those prices would be “transitory”. As it turns out, once supply caught up with demand, those prices came down; it just took longer to play out.

Growth And Inflation

Perhaps the most surprising part of the Fed’s pivot away from tightening is that the economy is running hotter than policymakers thought even a few months ago. At the September meeting, Fed officials expected GDP to increase 2.1 percent in 2023 accompanied by a 3.3 percent inflation rate. They also predicted one more rate increase would be needed to tame growth and prevent inflationary pressures from strengthening.

Three months later at the December policy meeting, that combination of growth and inflation expectations has been thrown in the dustbin, along with expected rate changes. In its fresh set of projections, the Fed now expects GDP to grow by a stronger 2.6 percent this year, even as it lowered inflation expectations by a half-percent to 2.8 percent. The rate increase predicted three months ago has been taken off the table, replaced by the three cuts predicted for next year.

Simply put, the Fed no longer sees growth as a driving force behind higher inflation, a striking about-face from the earlier sentiment – held as well by many prominent economists – that only a sharp rise in unemployment and lower wages could tame inflation. Indeed, Chair Powell acknowledged at his post-meeting press conference that he was (pleasantly) surprised that inflation continued to retreat amidst an economy that continues to grow at a healthy pace. Not all are convinced that this can continue, but some unfolding developments suggest that it can.

The Last Mile May Not Be So Tough

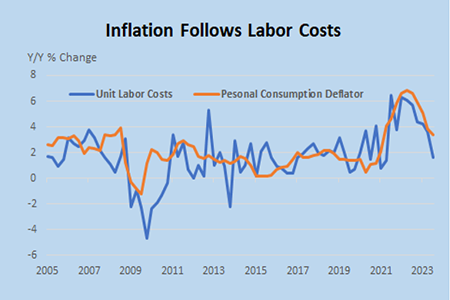

Despite the plunge in the inflation rate from over a 9 percent peak in 2022 to 3 percent, as measured by the overall consumer price index, there is a widespread sentiment that the easy pickings are over, and squeezing the last 1 percent out of the CPI will be much harder. While prices of many goods are falling, prices of services are still running too hot; many believe that the inflation retreat will stall out unless the underlying cause of service inflation, most notably labor costs, also comes down.

No doubt, prices of services are more closely linked to labor costs than are goods, whose prices are influenced more by the cost of materials, transportation, exchange rates, and other non-labor factors. Restaurants, bars, medical practitioners, barbers, among many other service providers, rely mostly on workers to generate revenues, hence labor expenses have a major influence on how prices are set. While wage growth has softened over the past year, it is running above the pace consistent with a 2 percent inflation rate. Average hourly earnings are increasing by more than 4 percent and median wages for a worker on the same job over the past year are increasing by more than 5 percent from a year ago, according to the Atlanta Federal Reserve’s Wage Tracker.

No doubt, prices of services are more closely linked to labor costs than are goods, whose prices are influenced more by the cost of materials, transportation, exchange rates, and other non-labor factors. Restaurants, bars, medical practitioners, barbers, among many other service providers, rely mostly on workers to generate revenues, hence labor expenses have a major influence on how prices are set. While wage growth has softened over the past year, it is running above the pace consistent with a 2 percent inflation rate. Average hourly earnings are increasing by more than 4 percent and median wages for a worker on the same job over the past year are increasing by more than 5 percent from a year ago, according to the Atlanta Federal Reserve’s Wage Tracker.

But a key reason these increases are not fully passed on to consumers is that productivity has also increased by at least as much. Output per hour in the nonfarm sector surged by 5.2 percent in the third quarter, which more than offset the increase in worker compensation. Hence, the cost per unit of worker output actually declined during the period. Indeed, over the past year, unit labor costs increased by 1.6 percent, which is comparable to the pre-pandemic pace, and has declined for five consecutive quarters from 6.1% in the second quarter of 2022.

Wage Growth To Slow

Clearly, the productivity surge over the past year is not sustainable, as it reflects special post-pandemic influences, such as the rebound in output as supply chains healed. The AI revolution may be playing a role as well, but that is likely having more of a positive influence on stock prices than on output, although its influence should increase over the longer term. Past innovations, such as the widespread adoption of personal computers, took decades before they had the broad, diffuse productivity-enhancing impact that lifts output in every sector. And recent, seemingly game-changing developments, such as the near universal adoption of smartphones, have yet to have any discernable impact on productivity, either positive or negative.

It makes sense to measure true productivity trends over the course of a cycle. Stripping out the noise caused by the pandemic and its aftermath, productivity has increased by an annual rate of 1.5 percent since the fourth quarter of 2019, the same growth rate seen on average between the fourth quarter of 2007 and the fourth quarter of 2019. Assuming productivity growth is reverting to its longer-term trend of 1.5 percent, it would be necessary to slow nominal wage growth to around 3.5 percent to be consistent with the Fed’s 2 percent inflation target.

Many believe that the labor market is too tight and worker bargaining power too strong for that to occur over the foreseeable future. The recent outsized gains by UPS and auto workers would seem to bear that out. However, workers bargained for those gains to catch-up to past inflation, not expected inflation. One of the key successes of the Fed is that its aggressive rate hiking campaign kept inflationary expectations anchored. Recent surveys, in fact, reveal that consumer inflation expectations are receding.

That said, worker bargaining power is tied to conditions in the job market. While unemployment is still historically low, that’s mainly because companies are not yet laying off workers. But overall labor conditions are easing, as unfilled positions are declining, fewer workers are quitting, people are coming off the sidelines to join the workforce, and unemployed workers are taking longer to find a job, as reflected in a steady rise in continuing claims for unemployment benefits.

This confluence of forces indicates that companies are cutting back hiring but are holding on to workers as they assess future staffing needs amid an expected slowing of economic activity. Workers are sensing this, and as they see a weakening job market, their wage demands are also easing. This unfolding scenario is looking ever more like a soft landing – a tapering off of wages and inflation without a recession-inducing spike in unemployment – which is precisely what the Fed is aiming for. The financial markets may be pricing in more rate cuts than the Fed will deliver, but it looks like policy is pivoting away from belt-tightening just in time.

Brookline Bank Executive Management

| Darryl J. Fess President & CEO [email protected] 617-927-7971 |

Robert E. Brown EVP & Division Executive Commercial Real Estate Banking [email protected] 617-927-7977 |

David B. L’Heureux EVP & Division Executive Commercial Banking dl’[email protected] 617-425-4646 |

Leslie Joannides-Burgos EVP & Division Executive Retail and Business Banking [email protected] 617-927-7913 |