No Rush to Cut Rates

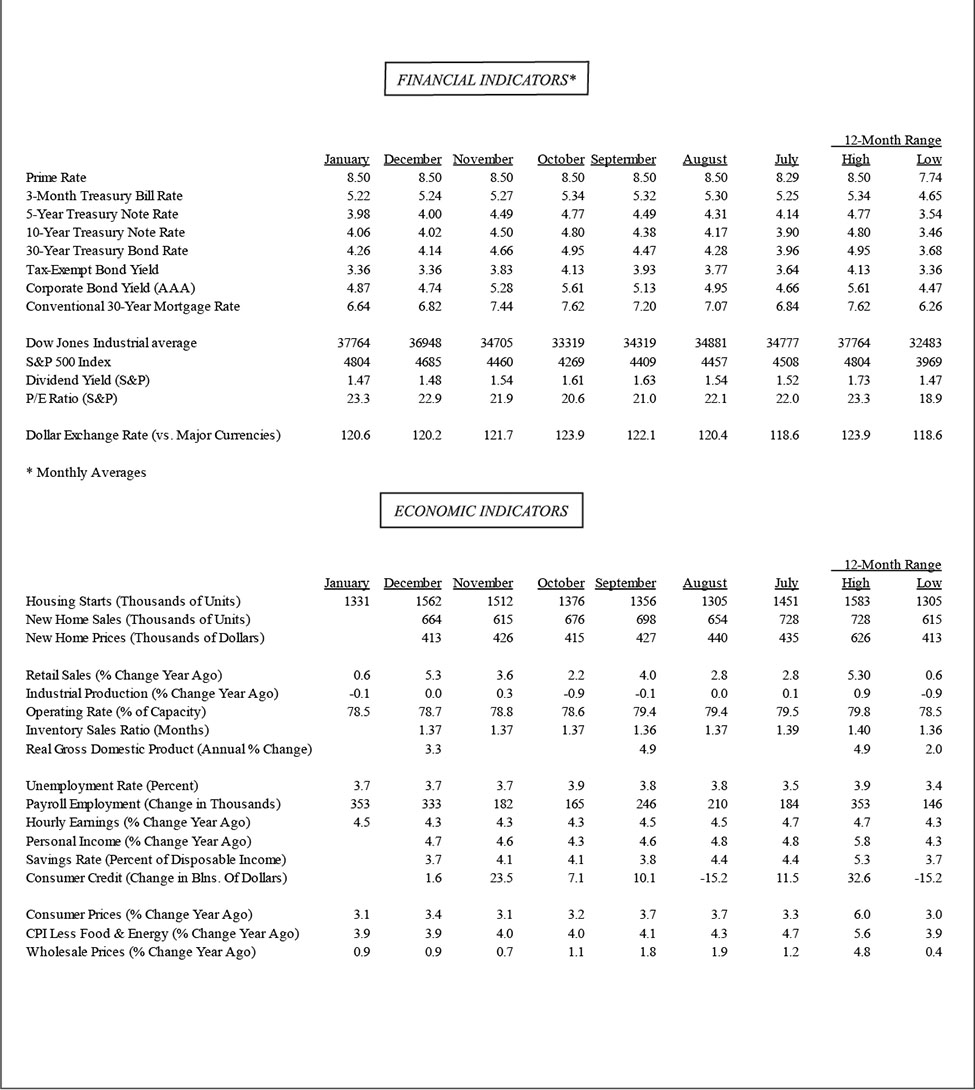

January tends to be an ornery month for economists, and the calendar did not disappoint this year. In the closing months of 2023, it appeared that a Goldilocks economy was unfolding, one that featured a cooling, but still solid, pace of economic activity amid a steady decline in inflation. Against this backdrop, investors had fully priced in expectations of a Federal Reserve rate cut as early as March; stock prices rallied strongly and bond yields plunged. But as notable baseball philosopher Yogi Berra famously said, “It ain’t over ’till it’s over.” As the curtain rose on 2024, things appeared to be going off the rails. Instead of cooling, some key economic indicators, most notably job growth, came in hotter than expected in January and, more disconcerting, inflation picked up.

To its credit, the Fed never capitulated to the growing rate-cutting pressure late last year. Despite the significant cooling of price pressures over the second half of the year, it was not convinced that inflation was firmly on the path to its 2 percent target. Wages were still growing too rapidly, service price increases remained elevated, and the economy as well as the job market continued to chug along in the face of more than 5 percentage points of interest rate increases since early 2022. Still, the Fed did pivot away from its rate-hiking campaign, projecting rate cuts in 2024 – just not as early or as steep as traders were expecting.

For a while, the markets and the Fed were at cross-purposes, as investors entered 2024 still expecting the central bank to cut rates early in the year. However, the employment and consumer price reports for January quickly put the kibosh on that notion. As the March policy meeting approaches, no one expects a move, as investors are now fully aligned with the Fed’s ongoing intention to keep rates “higher for longer.” The earliest rate cut currently priced into the markets is projected for May, and if incoming reports echo the strength in jobs and inflation shown in January, the first reduction could be delayed to the summer. The direction inflation takes in coming months not only impacts monetary policy and interest rates, but it could also influence the presidential election.

Inflation and the Elections

The presidential election is rapidly approaching, and the post-pandemic bout of alarmingly high inflation has pushed this issue to the top of people’s concerns. How voters perceive inflation, among other economic developments, will influence the outcome of what is set to be a rematch between incumbent President Joe Biden and former President Donald Trump. To be sure, subjective matters influence voter decisions, but they are impossible to build into economic models that rely on objective data to generate projections. However, polls show that Americans care deeply about inflation, and there are three scenarios voters in key battleground states may bring with them to the ballot box on election day.

The first scenario – which is aptly known as the sticker-shock situation – is one in which voters fixate on the cumulative increase in the level of consumer prices since Inauguration Day. This is the scenario that grabs headlines, as it is the one that people complain loudly about. Their anger is directed particularly towards items that are frequently purchased – such as groceries and gasoline – that cost 20 percent or more than on Inauguration Day. Unsurprisingly, this is the model that produces the most unfavorable result for the incumbent president.

While households typically focus on the level of prices – especially on basic necessities like food and energy – economists prefer to look at the change in consumer prices. The second scenario assumes that swing voters think more like economists and reward the incumbent president for the moderation in inflation. Clearly, inflation has fallen dramatically since hitting a peak in the fall of 2022. Even with the January surprise acceleration, the annual increase in the consumer price index has plunged to 3.1 percent from its 9.1 percent peak. What’s more, prices of many products are actually falling, particularly big-ticket items like used autos. Indeed, prices of all goods, excluding food and energy, are lower than they were a year ago for the first time since the post-pandemic inflation cycle got underway in 2022.

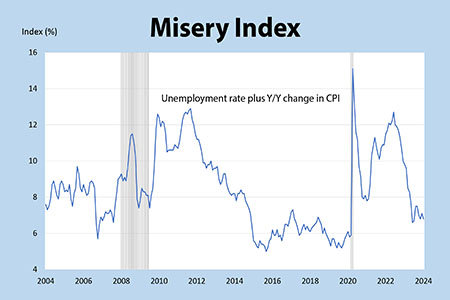

The third scenario is constructed in the spirit of what is commonly known as the misery index, a measure originally developed by economist Arthur Okun during the Carter Administration. This index is calculated by adding the annual inflation rate to the unemployment rate. Thanks mostly to the inflation retreat, this gauge has also fallen precipitously over the past year but is about where it was on Inauguration Day. On its face, therefore, it should not move the needle in voters’ minds one way or the other.

The January Effect

It is a time-honored adage in economics that one month does not make a trend. While that is true for any month, it is particularly the case when it comes to January. It’s important to remember that this month follows some key holidays, including Christmas, Hanukkah, and Thanksgiving. Companies ramp up seasonal hiring leading up to those events to accommodate an anticipated rush of sales. Conversely, when those holidays are over and sales revert to normal patterns, companies lay off those same workers.

The government statisticians recognize seasonal hiring quirks and adjust incoming data so that their seasonality is removed, and apples are compared to apples when gauging changes from month to month. However, the seasonal adjustments also change from year to year to account for evolving trends and it appears that they have become less reliable in the post-pandemic environment, which has upended traditional spending and hiring patterns. With labor costs accelerating amid a tight labor market, it’s likely that companies hired fewer seasonal workers than usual leading up to the holidays and, hence, had fewer layoffs than normal in January. Since the seasonal adjustment factors assume larger layoffs, they yielded a surprisingly strong seasonally adjusted increase in jobs in January that probably overstates the strength of the job market.

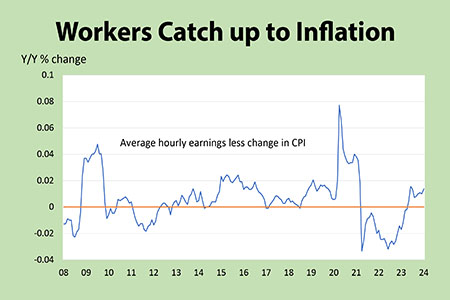

A similar story may apply to the surprisingly hot consumer price report during the month. January is when businesses tend to reset prices to recover the higher costs incurred over the previous year. Not only did worker earnings stage a robust advance last year – well above the pre-pandemic trend – it was the first time since 2020 that average hourly earnings increased faster than consumer prices. Recall that some major union contracts that generated hefty pay raises were negotiated during the year. Importantly, service sector employees received the biggest wage increases, as labor shortages were particularly severe for restaurants, hospitality, and health care workers. This is significant because labor costs have a much bigger influence on prices in the services sector than they do in the goods-producing sectors.

Bumpy Road

The larger than expected increase in the consumer price index in January was likely influenced by these one-off factors, just as the surge in payrolls reflected fewer layoffs than normal rather than a burst of actual hiring. Both inflation and job growth should revert to a cooling trend in coming months. That said, the hotter than expected data during the month was a wake-up call for rate-cutting advocates who believed that the inflation retreat was on a one-way path towards 2 percent, encouraging the Fed to cut rates sooner than later. The economy rarely moves in a linear fashion, as potholes are more likely than not to cause mid-course corrections. The challenge for policy makers is to recognize the bumps in the road and remain focused on the broader picture.

Odds are, just as the Fed held firm while inflation receded late last year, it is not likely to let a one-month flareup in consumer prices and job growth sway it from its intention to lower rates later this year. That plan – to cut rates by about three-quarters of a percent – was presented in the economic projections at the December policy meeting, when the prospect for a soft landing loomed large. Unfortunately, the financial markets took that prospect and ran with it, racing far ahead of reality. The wake-up call in the January data brought investors back to their senses. That said, this is no time for complacency and the Fed needs to stay nimble in its approach to policy in coming months.

Keep in mind that the economy has landed in a good place – still chugging along even as inflation is receding – due to a combination of flexible policy decisions as well as good luck. When the Fed realized that it waited too long to start pushing back on inflation – believing it was due to a transitory shock – it abruptly changed course and aggressively slammed on the brakes starting in the spring of 2022. That delayed response led to a long catch-up phase that generated the steepest rate-hiking cycle in more than forty years. Importantly, it stayed the course until pausing in July of last year despite mounting calls that the economy would suffer a hard landing.

Good Luck

The fact that the economy remained so resilient has as much to do with luck as with policy decisions. In fact, the Fed was prepared to accept a mild recession to conquer the inflation dragon and was just as surprised by the economy’s muscular performance late last year as everyone else. Clearly, it underestimated the firepower that the huge pandemic-era savings buildup had in stoking the economy’s growth. It also underestimated the supply of workers that would return to the labor force, allowing wage growth to cool amid a hot job market.

However, banking on more good luck is not a strategy. The Fed’s decision to keep rates higher for longer – which was reaffirmed at the late January policy meeting – heightens the risk that a hard landing will be the price paid for overstaying the inflation fight. The hotter than expected January data validates the Fed’s decision to keep rates elevated for now, but it also signaled that it is more concerned about cutting rates prematurely before inflation is decisively under control, rather than waiting too long and risk a recession. That preference is a bit odd, as there is a lot of disinflation in the pipeline, particularly for goods, and the wage hikes last year that are putting pressure on service prices are in the rear-view mirror. If the central bank waits for clear signs that the job market, as well as the broader economy, is deteriorating, it will be behind the curve, much as it was behind the inflation curve in the spring of 2022. In that case, it may require a lot of luck to avoid a recession.

Brookline Bank Executive Management

| Darryl J. Fess President & CEO [email protected] 617-927-7971 |

Robert E. Brown EVP & Division Executive Commercial Real Estate Banking [email protected] 617-927-7977 |

David B. L’Heureux EVP & Division Executive Commercial Banking [email protected] 617-425-4646 |

Leslie Joannides-Burgos EVP & Division Executive Retail and Business Banking [email protected] 617-927-7913 |